For those who follows the news of futures market quite tightly, you may have just seen an once in a lifetime situation, where the futures contract for West Texas Intermedia Crude Oil (a.k.a. WTI Crude) has dropped below $0 per barrel, and has reached -$37.63 per barrel! That means, technically those who have WTI Crude on their hand, they would have paid you to buy their oils! Fascinating isn't it? However, that apparently is not the case. To understand what's going on, we will have to first dive into what is Futures Contract.

Futures Contract

Unlike what your friends are talking about, the price of WTI Crude itself did not plunged below $0 per barrel. In fact, it was the WTI Crude May 2020 contract that expires on 21st of April 2020 that fell below $0 per barrel. Yes, it was a specific contract that fell below $0 per barrel, and not the price of the oil itself.

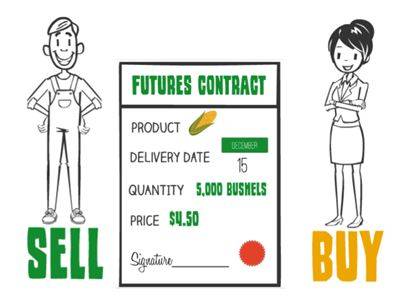

Futures or Futures Contract is a type of agreement to stipulate the goods, price of the goods and deliver time of the goods in advance. That means, WTI Crude May 2020 contract would means that WTI will be delivering a contract size of crude oil on May 2020, and the price of each barrel will be the price stated on the contract to whomever owns the contract after the contract has matured.

A contract size would be 1000 barrel of crude oil, or 42,000 US Gallon, and approximately 160,000 litres. However, most investors and futures contract buyers usually do not want the crude oil itself. They only want to make a profit from buying the contract at a lower price, and selling the contract at a higher price.

Since buying a futures contract would only require the buyer to pay a margin price, instead of paying the full amount of the product, a lot of futures contract buyer would buy the contract at a lower price, then sell it when the contract price is higher, before it expires.

Why would WTI Crude May '20 contract fall below negative?

WTI Crude May '20 contract expires on 21st of April 2020, anyone who owns the contract would have one or multiple contract size of crude oil delivering to them. If the current owner of WTI Crude MAy '20 contract do not want to receive multiple contract size of crude oil, and we are talking about multiple barrel of crude oil, they will need to sell their contract before the contract expires, and before NYMEX stops trading.

Due to the COVID-19 pandemic, the demand of crude oil is at all times low. No one would want to buy futures contract of a crude oil, hence those who currently owns the futures contract are giving out money to other potential buyers to buy their contract away from them, which leads to the one in a lifetime wonder at the midnight of 21st of April 2020, whereas the price of the WTI Crude futures contract has plunged below $0 and reached negative price.

One note to be mentioned is that, the other reason that WTI crude oil plunged is that WTI crude oil would requires the contract holder to collect their oil Cushing Oklahoma, the contract cannot be rolled-over, and the buyer cannot have their crude oil delivered offshore to a variety of locations. Buys can only collect only at Cushing, Oklahoma, which leads to contract holder dumping their futures contract to avoid taking a physical delivery of one or few contract size of crude oils.

If I buys the contract, does it mean WTI will pay me to receive the oil?

Short answer: No.

As I have mentioned above, it was not the price of WTI Crude Oil that plunged below $0 per barrel, it was a WTI crude oil futures contract of a specific month that fell below $0 per barrel. Therefore, what the sellers are paying you to buy is the futures contract itself, and not the goods that specified in the contract.

The margin of WTI crude is 7% of the current contract price and the contract size of WTI crude is 1000 barrel. Therefore, those who bought a contract size of WTI crude that was expired on 21st of April 2020, they will be paid $37.63 × 1000 × 7% = $2634.10 to receive the contract by the seller. HOWEVER, as a new contract owner, you will be paying for 1000 barrel of crude oil from WTI crude producer, at a previously stipulated price. If the previously stipulated price for the future contract is $40 per barrel, that means as a new contract owner, you will be paying $40000 to WTI crude producers for 1000 barrel of crude oil delivering to your warehouse.

Unless you owns a crude oil refinery, otherwise you will have no use for 1000 barrel of crude oil. You might not even have any warehouse or oil storage to store the 1000 barrel of crude oil.

How does it affect Malaysian or Malaysia?

It does not affect Malaysia or Malaysians. The price that plunged is the price of the futures contract that expires on a specific month of WTI crude. There might be a few contract traders and buyer went bankrupt at this historical moment, however it only affects contract traders and buyer, it will not affect a casual Malaysian. It certainly will also not affect the price of the petrol we fill our car as well.

One note to be taken is that, WTI crude oil is one of the many crude oil on the market, and it only reflects the price of the light sweet crude oil that is produced in West Texas. In Malaysia, we have our own sweet crude oil, it is called Tapis crude oil, and it is still standing at $27 per barrel as per the author wrote this article. Not to mention, Brent Crude, a UK produced oil that normally used for benchmark the oil price, is still standing strong at $20 per barrel.

Summary

- It was the price of the WTI Crude Oil May '20 futures contract that has expired on 21st of April 2020 that plunged below $0, not the actual market price of WTI crude oil.

- Buying the contract will not provide you free crude oil. It will only provides you a free contract, which you will have to pay WTI for the crude oil later, or you will suffer a penalty.

- Those crude oil are unrefined and cannot be used on your car. Buying 1000 barrel of them is pointless. You will not even have a warehouse big enough to store them. We are talking about 1000 barrel, or 42,000 US gallon, or approximately 160,000 litres of crude oil.

- Brent crude, a widely used benchmark, is not affected.

- Malaysia Tapis crude oil is not affected by this.

Sources and references:

JOIN MOpress.io express your love & experience with the world!